Senate May Pass Internet Sales Tax, Online Retailers Worried

April 25th, 2013As we speak, the US Senate is debating the alleged merits of the misguided and destructive Marketplace Fairness Act of 2013. As it stands, online retailers are required to pay taxes in the state in which the company maintains a physical presence. Retailers typically collect sales taxes and pay them on behalf of consumers, and this system has been in place ever since the Quill Corp. v. North Dakota case set the precedent on this issue.

As a result, most online retailers have gravitated towards states and localities with lower sales taxes. This is quite rational. However, some states are beginning to worry about their sales tax revenues in light of the fact that more and more consumers are passing over brick-and-mortar retailers in favor of better and more convenient deals online. As a result, legislators crafted the “Marketplace Fairness Act” in an effort to flip the entire system on its head. Rather than having businesses pay the tax in their own state, this new bill would require businesses to pay sales taxes according to each consumer’s local rules instead, which would necessarily change from one transaction to the next between thousands of different potential combinations of state and local taxes. Is it a good idea to break our tax system and destroy online shopping just because some states are driving online businesses away with high sales taxes?

Online Retailers Are a Rare Bright Spot in the Economy

The world economy has been struggling since the crash of 2007. Few new productive industries have emerged since that time. However, consumers have fallen in love with online shopping. Prices are lower online, and shoppers appreciate having goods shipped right to their front doors.

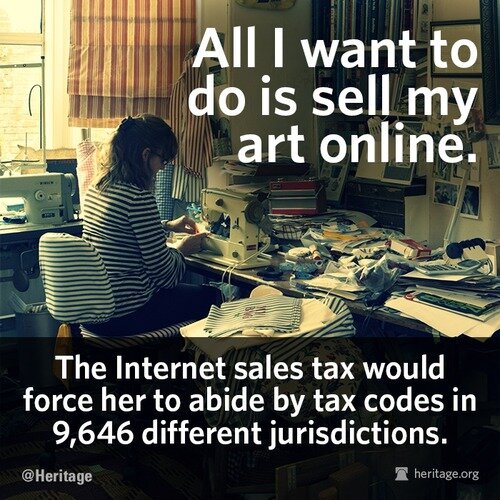

Meanwhile, lots of jobless entrepreneurs recently began selling things online as a way to make ends meet. Some web users leverage their expertise and influence to sell products based on affiliate marketing arrangements. There are lots of people making arts and crafts and selling them on platforms like eBay and Etsy. Online retailers are trying their best in a tough time, and this is not the right moment to slow things down with a confusing new tax.

The Existing System Is Simpler and Still Enforces Sales Taxes

It makes the most sense for a business to pay a sales tax in the locality in which the moneys are taken. This allows the company to use a standard calculation at the end of each point of sale. The Marketplace Fairness Act of 2013 would force online retailers to comply with an almost unknowable number of changing tax rules in thousands of municipalities and 50 US states. This might be possible for Amazon.com to pull off with its unlimited funds and legal team on retainer, but a brand new home-based startup with a hot craft item on eBay could easily wind up in tax trouble after failing to notice a local sales tax.

Also, when businesses deal with one specific, knowable tax, it’s possible for products to be priced in a way that accounts for the final total facing a consumer. If each product is taxed differently based on who is buying it, how can a company price products competitively? Taxes in one state or municipality might push a price higher than consumers are willing to pay.

As it stands, businesses pay sales taxes in the states in which they are located. This system works. Some states have lower sales taxes, and they’re attracting online retailers in a way that states with high sales taxes are not. Rather than breaking the entire system and forcing every company in America to interact with 9000+ different combinations of governments on each and every online transaction, states with punitively high sales taxes should solve this problem by trimming or cutting the offending tax. This would invite online retailers to set up shop in those states.

The Senate is set to vote on the bill, possibly by the end of the week. If you oppose this new internet sales tax, there’s still time to contact your legislators. Meanwhile, feel free to engage in some online shopping and pick up a copy of the Silver Circle graphic novel, before this backwards new tax scheme kicks in and complicates the transaction.

Find out where you can see Silver Circle by checking our theater and special screening schedule on -->our event page -->.