Navigating Kitco.com

July 13th, 2010

Kitco.com is a website that facilitates the buying and selling of precious metals. The exchange of precious metals is not usually on most people’s radars unless they’re buying jewelry,* which has aesthetic value. As we associate precious metals with their most conspicuous function, we may also separate the value of jewelry, which we buy for its craftsmanship, from the value of its raw materials, the metals themselves. Yet it’s important to remember that the value of these raw materials extends far beyond their status.

There is a market for gold and silver in its pure form. Following and interpreting this market is not only important for those who buy and sell gold, but also functions as an important indicator of economic trends. Though the success of the economy and the price of gold are not the same (they are usually inversely proportional), they have a strong correlation. For now, let’s take a look at gold, the most standard indicator of precious metal quotes, though silver and other precious metals function in a similar way.

Kitco.com is the gateway to the precious metals market. The google of gold prices, this website tracks, and, in doing so, establishes the fluctuating value of precious metals. Kitco.com defines prices by two methods, the London fix and the spot market.

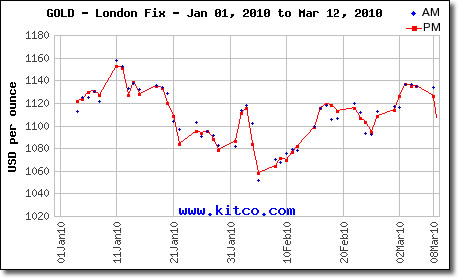

1. Twice each business day, The London Gold Market Fixing Ltd. publishes a price for gold called the London Fix, which is recognized as the most standard benchmark for the price of gold. The morning value is called the AM fix and the evening value is the PM fix. Americans use the PM fix because it is published at 3:00 PM in London to coincide with the opening of US markets. The AM fix, published in London at 10:30 AM, is practically irrelevant to us because it comes out in the middle of the night. [Note: If you are an American concerned with the AM fix, you have taken your new knowledge of the precious metals market too far. Go to sleep.]

Essentially, the fix is based on a pyramid of bankers. The chairman of The London Gold Market Fixing Ltd. is on top, presenting a “trying” fix to five more members of this organization, who then relay the price to their dealing rooms, which are in contact with more dealers, who have more clients, etc. Essentially, banks all over the world barter for a set amount of gold until a price is “fixed.” You can find the current AM and PM fixes, titled, “London Gold Fix,” on the left side of Kitco.com, halfway down the page. It lists prices in United States dollars (USD), Pound sterling (GBP), and the euro (EUR).

Like the stock market, you play the game by trying to buy below the fix and sell above it. This, of course, does not have to apply to every transaction because the fix changes daily. Furthermore, some people prefer to make deals based on whatever the price of the fix will be two days later; because no one knows if the fix will go up or down, this can ensure a fairer price for the buyer.

2. According to Kitco.com, “The spot gold price refers to the price of gold for immediate delivery.” Unlike the London fix, it is constantly updating (as fast as it takes to refresh the page) based on transactions between bullion dealers worldwide, and is therefore open almost 24 hours a day to account for different time zones. The live spot is comprised of the bid (an estimation of what your gold will sell for), the ask (an estimation of what it will cost you to buy), and the high and low (the lowest bid and the highest ask of the trading period at Kitco.com per day). The difference between the bid and the ask is called the spread; a small spread often indicates that the price of gold is going up and a large spread that the price will take a downturn.

When I asked a refiner why someone would trade according to the spot market, he replied, “because they don’t know any better.” Kitco advertises the spot gold price as better suited for smaller sales, such as bullion coins, as opposed to the London fix, which is best for mines, refiners, fabricators, and banks. However, when it comes down to it, the live spot is merely a suggestion, which only gives an illusion of standardization because those that “don’t know any better” use it to establish their prices.

Like all commodities, gold is only worth what someone will pay for it, and the London fix is a more apt gauge of what someone should pay for it. I find it interesting that Kitco.com features the spot price at the top of their webpage, whereas you have to scroll down for the London fix. Don’t fall for it, new metals traders, engage those mouse-fingers.

Most of Kitco.com features constantly updating news articles related to precious metals prices. This is a great source if you would like to learn more about the market. Silver Circle endorses Reuters and Business Week as sources, but suggests navigating away from Kitco News and John Nadler.

Though silver and other precious metals are featured on Kitco.com halfway down the right side of the page, people use, Comex, a similar website based on the New York Mercantile Exchange, for a more in-depth look.

*or our silver !

Posted by: