Fed News Friday: Obama Nominates Wall Street Banker to Watch and Regulate Wall Street Banks

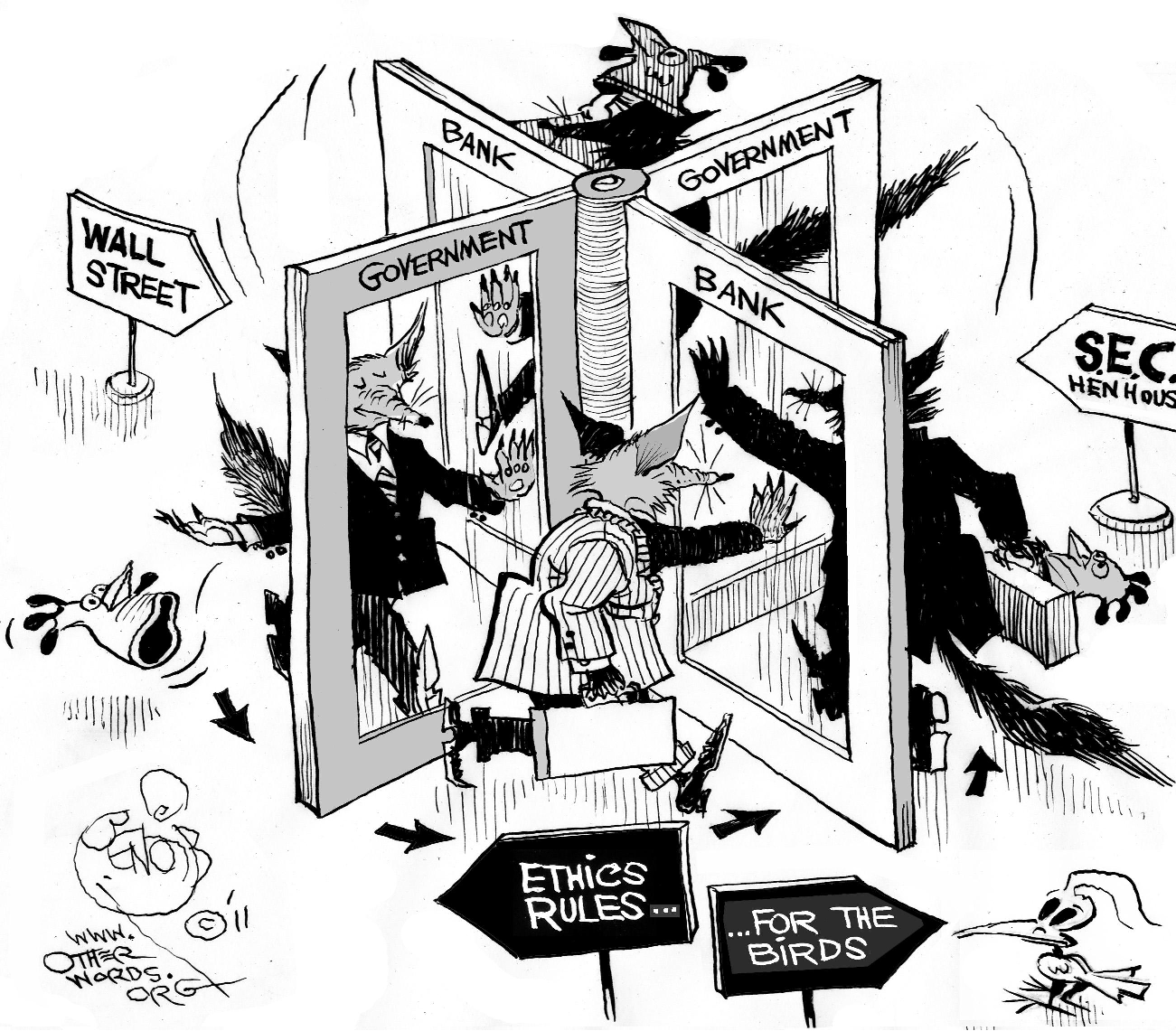

March 30th, 2012What don’t people understand about this??? Appointing industry insiders to be regulators of their own industries not only doesn’t solve the problems in those industries, it’s proof positive that regulations and regulatory agencies DON’T work for you, they work for the big corporations that they are supposed to be watching. It happens again, and again, and again. The problem is too deep, too systemic, and too common not to see that it is an inherent problem with regulation and the regulatory state itself. It just doesn’t work. If even Mr. Hope and Change himself: Barack O-freaking-bama just can’t pass on the pressure to nominate these corrupt bankers to police themselves, then it’s time for the regulatory hawks to finally realize and admit that the problem is with the system itself. Government regulation only makes things worse. Here’s the scoop:

The U.S. Senate on Thursday approved dozens of Obama administration appointees, including top financial-industry regulators at three federal agencies.

But lawmakers failed to reach agreement on two outstanding nominees to the Federal Reserve Board, leaving the nominations of Jerome Powell, a former private-equity executive, and Jeremy Stein, a Harvard University economics professor, for a later date.

The Senate, in voice votes, confirmed three nominees to the Federal Deposit Insurance Corp.’s board. They are Martin Gruenberg as chairman, Thomas Hoenig as vice chairman and Jeremiah Norton as a director. Mr. Gruenberg has sat on the FDIC’s board since 2005. It also confirmed Thomas Curry as Comptroller of the Currency, heading the U.S. Treasury agency that regulates the country’s largest banks. Mr. Curry will also sit on the FDIC’s board.

The FDIC’s board, like other government panels, can’t have more than three members of one political party. To comply with that mandate, Mr. Obama nominated two officials with Republican backing: Mr. Hoenig, who is a former president of the Kansas City Federal Reserve Bank and Mr. Norton, a former official in President George W. Bush’s administration who is now an executive with J.P. Morgan Chase & Co.

Does anyone else see what’s wrong with that? The FDIC is a government-sponsored corporation that insures bank deposits and acts as a regulatory watch dog to supervise banks and financial institutions for the soundness of their policies and investments, to provide protections to consumers against banks, and to manage banks in failure. And Obama appoints a big Wall Street banker to serve as a director on the board of this institution? It’s absolutely and positively corrupt to its core. It’s a corrupt system. Regulatory hawks among the the Democratic Party’s rank and file need to either admit that their bright shining knight of change, transparency, and openness who was supposed to clean up Washington is totally corrupt for a move like this, or they have to admit that regulation itself is completely futile and creates a system that is inherently corrupt, putting pressures on even people like their beloved Obama to make such egregious choices and on one hundred Senators to confirm those decisions.

Why does this happen? Because regulatory agencies act as magnets for people from within the very agencies they are supposed to regulate. This is a natural and predictable outcome for more than one reason. To begin with, in order to regulate and watch an industry, the regulator necessarily requires an intimate knowledge of it, meaning that just about anyone other than industry insiders are not qualified to be regulators of that industry. And of course regulatory agencies attract industry insiders because it is profitable for the industry’s big players to get in the business of regulating themselves and their smaller competitors. This is allowed to happen because it’s electorally profitable for legislators to make friends with big industry players whose people will gratefully donate to their reelection campaigns so they can stay in Washington and keep greasing the wheels.

There’s no way around it. There’s no way to fix it. There’s no number of perfect saints that you can promise to find that will hold these offices and conduct their regulation honestly and without bias. For the reasons above, corruption and insider bias is an inherent and unavoidable part of top-down, centrally-planned, government regulation of an economy and its various industries. Aren’t Democrats supposed to be hard on those big evil corporations? A Democratic president appointed a big, evil corporation’s employee to regulate that same big evil corporation and a Democratic Senate confirmed the appointment. Is anyone else losing their minds watching this circus unfold right before our very eyes, but more maddening still, is anyone else watching the rest of America ignoring it and letting it happen?

This is NOT okay! Hit the freaking share button!

And don’t forget to visit our official website to learn more about the Silver Circle Movie:http://SilverCircleMovie.com