Money Monday: After Brutal August Jobs Report, Bernanke May Unleash QE3

September 10th, 2012The August jobs report is in from the Bureau of Labor Statistics, and the results are not pretty. With only 96,000 jobs added in August, new job hires fell short of the mark necessary to keep up with the natural growth in population.

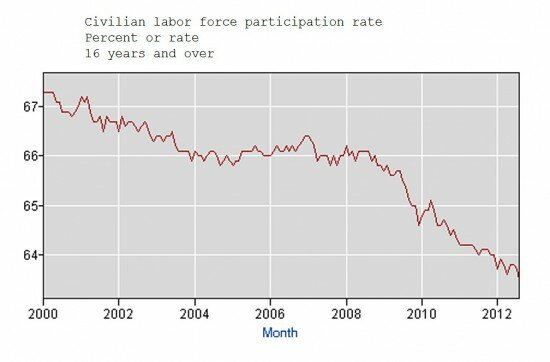

Unemployment technically fell from 8.3% to 8.1%, but this has less to do with employment gains and more to do with fuzzy math — the drop was caused by the labor participation rate falling as discouraged workers gave up on looking for a job. To make matters worse, analysts are suggesting that Federal Reserve Chair Ben Bernanke may turn on the monetary printing presses for a third round of inflationary Quantitative Easing, despite the fact that the two previous rounds did not stimulate employment.

August Jobs Report Shows Worsening Unemployment Crisis

As reported by The Hill’s Congress Blog, the labor force participation rate dropped to 63.5%, the lowest figure since the beginning of Ronald Reagan’s first presidential term. For men, the labor force participation rate is at an historic low of 72.7%. As unemployment levels rise, so do crime rates and the possibility of social unrest.

Young people were exceptionally hard hit as the 20-25 year old labor participation rate fell further than any other demographic group. Employment gains have slowed year-over-year as well.

Analysts Expect Ben Bernanke to Unleash QE3

After this brutal jobs report, market analysts across the spectrum are predicting that the Federal Reserve will take action and let loose another round of Quantitative Easing in a misguided effort to stimulate employment. With an unemployment crisis still looming after two rounds of QE, more and more pundits grow skeptical of the program.

While Ben Bernanke has yet to confirm whether or not this inflationary technique will be used once again, countless analysts have warned that the continuation of the policy could lead to an inflationary crisis. With food and fuel prices rising due to recent weather events, lower income families could be left paying for this “stimulus” program in the form of higher prices at the grocery store and gas pump.

The inflationary effects of both appropriated Congressional funds and Quantitative Easing programs lag as it takes time for new money to reach the point of sale at stores, so previous rounds may still cause further price inflation with time. The scary reality is that QE3 could cause more inflation than the economy can tolerate, leading to higher prices on top of an already struggling job market.

The Federal Reserve could take action as soon as Thursday according to some analysts. With recent hurricanes and savage droughts already affecting fuel and food supplies, the inflationary effects of another round of easing may spell deep suffering for those discouraged and unemployed people referenced in August’s jobs report from the Bureau of Labor Statistics.

Feel free to visit our website at http://www.SilverCircleMovie.com to find out more about our upcoming 3D animated film!