Student Loan Bubble Inflating Rapidly As Job Market Collapses

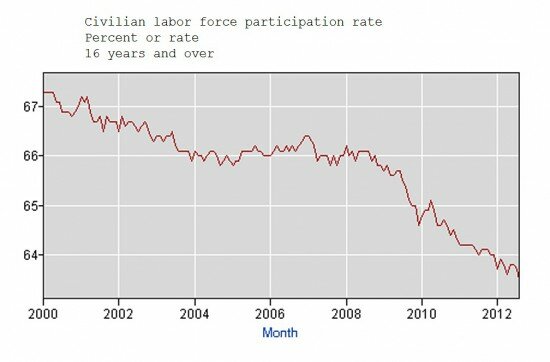

April 8th, 2013Recent economic reports are demonstrating some serious underlying weaknesses in the US economy. First of all, new disability claims outpaced jobs created in the past month’s labor figures. The labor participation rate dropped to the lowest level since 1979 as large numbers of discouraged workers gave up looking for a job.

Meanwhile, Zerohedge is reporting that the consumer credit market has been swallowed whole by student and car loans, with those types of purchases representing 97% of February 2013′s credit transactions. Both student and car loans are non-revolving credit products, many of which won’t be paid back in the end due to federal mandates that force banks to make risky loans to unworthy borrowers. To make matters worse, Federal Reserve policy has led to the rise of the sub-prime auto loan, shortly after similar products eviscerated the housing market. Speaking of which, the Obama administration is pressuring banks to continue issuing home loans to risky borrowers, proving no lessons have been learned from the housing crash of 2007. Let’s piece through this economic insanity after the jump.

One Intervention After the Other

First of all, the fact that new disability claims are outpacing new jobs seems to demonstrate that some workers are having an easier time defrauding the Social Security program than finding a job. Unless some phenomenon is causing widespread maiming, disease, or injury, there shouldn’t be inordinate spikes in disability claims due to economic factors. However, can they be blamed? If one has been looking for a job for months to no avail, claiming that one’s quick temper is a crippling form of bipolar disorder, thus rendering employment impossible, leads to a paycheck faster than sending thousands of resumes to companies that would rather wait until Obamacare case law is settled before they hire someone.

Meanwhile, the labor force participation rate has plummeted, and, due to the way unemployment figures are calculated, this has somehow caused the unemployment rate to drop, despite an increase in actual joblessness. The government keeps some shifty figures on the books to make situations look rosier than they really are, and the difference between the labor force participation rate and the unemployment rate demonstrates this clearly.

Bubbles Are Inflating in the Credit Markets

The housing market has been artificially pumped up via QE3 and subsequent securities purchases by the Fed. Federal Reserve programs have also caused an explosion in sub-prime auto loans. Government-backed student loans are flooding into the market so quickly that they represent a disproportionately massive percentage of all credit transactions. This means that a huge chunk of US loans are going to college students without jobs, who may never find them.

Since the government has forced banks to issue student loans to a variety of families who can’t afford to pay them back, a student loan bubble is forming. Eventually, the due date will come on these loans, which are expanding rapidly in number to a size that could bring the economy to the brink of disaster if a significant number of them had to be deducted from bank balance sheets at once due to widespread defaults. When the costs of the student loans outpace the salaries earned by graduates, it’s safe to say that many of them are destined for default.

What will happen to the economy when these and other bubbles pop? Our only option is to wait and see, as the interventions that cause these problems seem set to continue for the foreseeable future.

Find out where you can see Silver Circle by checking our theater and special screening schedule on -->our event page -->.