Fed News Friday: Volcker Says Good-bye & Bernanke’s Hopes Are High

January 7th, 2011Paul Volcker is leaving Obama’s economic advisory board. The decision seemed to have been a long time coming. Volcker saw the board as a public relations tool instead of an instrumental step toward financial recovery.

Volcker is well known for calming inflation in the 1970-80′s as Fed Chairman. His views from his experience in the 80′s reflected on his goals in today’s economic crisis. The former Fed Chairman rose interest rates to over 20% in 1981 causing protest over the unpopular monetary decision. However, he continued on, prevented stagflation, and stabilized the economy (“stabilized” may not be the word to use here).

Our new head of the Subcommittee on monetary policy has had a few words praising the former Fed Chair.

“Being in Congress in the late 1970s and early 1980s and serving on the House Banking Committee, I met and got to question several Federal Reserve chairmen: Arthur Burns, G. William Miller and Paul Volcker. Of the three, I had the most interaction with Volcker. He was more personable and smarter than the others, including the more recent board chairmen Alan Greenspan and Ben Bernanke.” – Congressman Ron Paul

Looks like Obama is cleaning out his advisory board and Volcker’s not the only one to go. The position was designated for two years and expires on February 6th. Lawrence Summers, the director of the National Economic Council will also be shipping off back to our neighborhood (maybe we’ll catch him around Harvard next time we are out selling silver for $5).

____

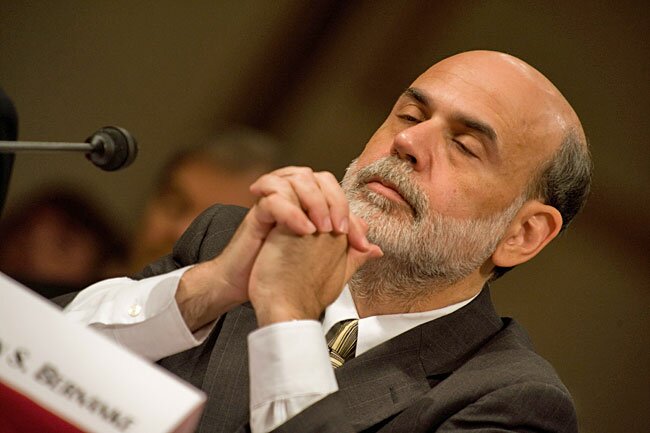

Ben Bernanke, the Federal Reserve Chariman, testified before the Senate Budget Committee today and his sentiments were a tad on the optimistic side. He stated that he sees a, “moderately stronger 2011,” up ahead. Unemployment has dropped .3% to 9.4% and employers have added a little over 100,000 new positions.

If you recall, last year the budget planning was cancelled. This year the Senate Budget Committee seems to be taking business very seriously. Senator Jeff Sessions told the committee and Bernanke today, “We need to return to the fundamentals…payin’ your bills on time.” Sessions also referred to Bernanke as the “Master” which caused quite the smirk to form across Bernanke’s face. I think most of us agree that’s a fitting nickname, he did win Person of the Year in 2009!

Bernanke’s confidence, if you want to call it that, was still not enough for the Fed to draw back their plans for the 2nd round of quantitative easing. That money will continue to be printed, and it’s speculated that the dollar amount could reach over a trillion by next summer.

On February 3rd, Bernanke will hold a press conference with the public. This will be the first time he’s taken questions from journalists at a press conference in 2 years. This should be an event!

Whew! Glad we could catch up. See you next week!